Financial Insights for TSP Investors

TSP Allocations Straight to Your Inbox

TSP Pilot makes it simple to manage your TSP with our example fund portfolios and easy-to-read market analysis. Easily cancel anytime.

100% Money Back Guarantee

- 20 years of experience

- Set up in minutes

- 2,000+ Members

- 20 years of experience

- Set up in minutes

- 2,000+ Members

G Fund | L Income | Conservative | Aggresive | |

|---|---|---|---|---|

Average return over 10 years | 2.30% | 4.15% | 4.59% | 6.46% |

$100k invested over 10 years | $125,532.55 | $150.173.31 | $156,639.62 | $187,009.91 |

Based on 10 year annualized returns as of November 30, 2023

Over $593,159,301 in estimated returns for our members

About Us

Founded in 2004 by Benjamin Rich, a former federal employee with a passion for financial planning, TSP Pilot has become a trusted resource for Thrift Savings Plan investors. Under the leadership of his grandson Jackson Rich, who holds a degree in Economics from the University of North Carolina at Chapel Hill, TSP Pilot continues to help thousands of federal employees make the most of their TSP investments.

Our passionate team brings decades of experience and valuable insights to our services. We are dedicated to leveraging technology to deliver the most straightforward and beneficial service to our users, maintaining our reputation for excellence and reliability. Whether you’re just starting your career or approaching retirement, we’re here to help you navigate your TSP investments with confidence. If you have any questions, feel free to contact me personally at ja*****@ts******.com. I’m always happy to help.

How It Works

We analyze the markets

Take the guesswork and emotion out of investing and rely on our objective opinion and proven experience.

We send our recommendations

Bi-weekly emails and texts will help you how to manage your TSP like a pro – with full breakdowns on our members-only dashboard.

You move your funds yourself

You can decide if you want to follow our lead. Make fund changes via TSP.gov as you normally would.

100% Money Back Guarantee

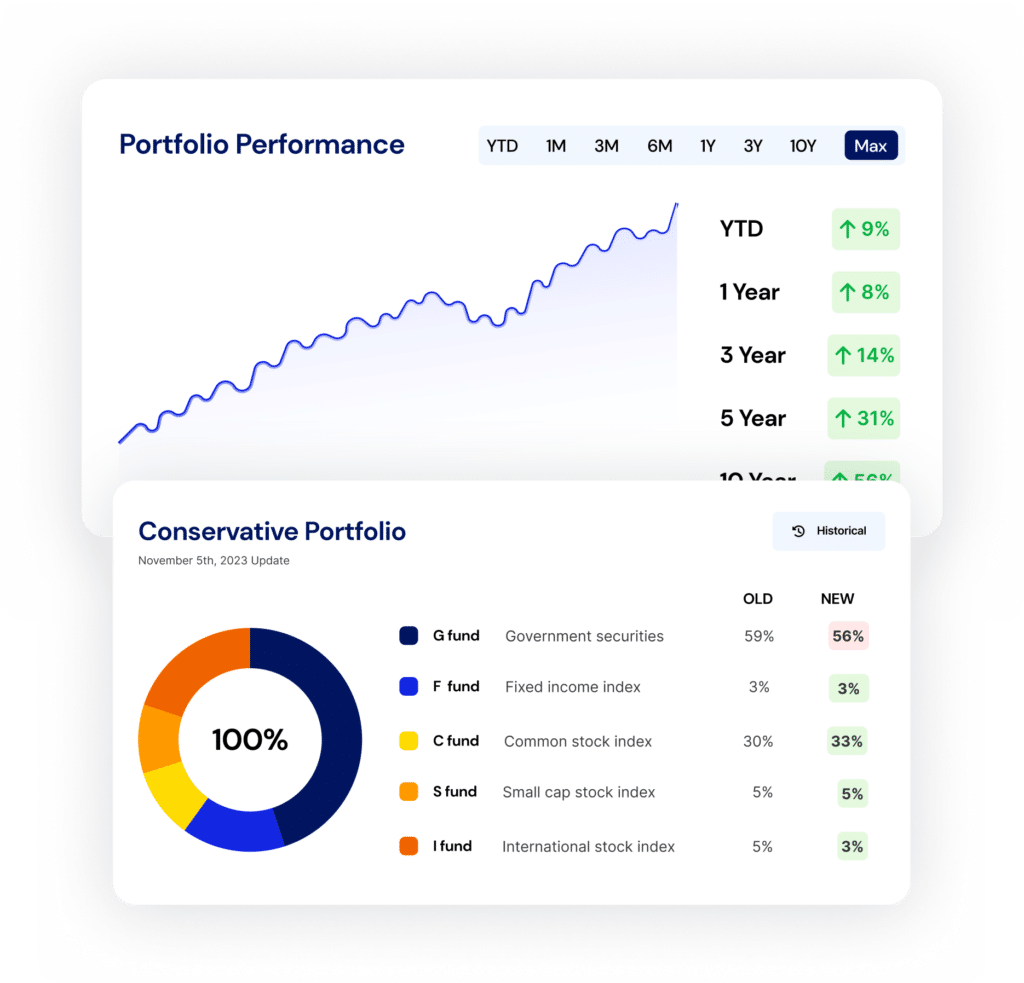

Get Great Returns

Access TSP Pilot’s high-performing fund allocations created by our financial experts. Choose from Conservative and Aggressive options to suit your investing goals.

Understand the Market

Know what’s impacting your retirement in under 10 minutes a week with our easy-to-read market summaries – and how to adjust fund percentages accordingly.

Sleep Better at Night

Rest assured knowing that TSP Pilot has performed exceptionally well since our 2004 inception, withstanding the test of time through both bull and bear markets.

Why TSP Pilot

Simplified, Actionable Analysis

Understand the market with our easy-to-understand market insights – delivered straight to your inbox.

Regular Updates

Our emails and texts will help you manage your TSP like a pro – with full breakdowns on our members-only dashboard.

Proven Profits Since 2004

View up to date performance information from as far back as 2004 directly on our website.

100% Money Back Guarantee

- 20 years of experience

- Set up in minutes

- 2,000+ Members

- 20 years of experience

- Set up in minutes

- 2,000+ Members

Thousands of Happy Members

Having been with the Federal Government for nearly 20 years, I enrolled in the TSP Pilot early on. Having sound market knowledge from the TSP Pilot has enabled me to build toward a sound and comfortable retirement.

Inspite of the current market challenges, I remain assured, my money is protected from market turbulence. I highly recommend anyone participating in the TSP subscribe to TSP Pilot.

Travis M.

I started on TSP Pilot in 2010 after a co-worker told me about it. Once I decided on my risk level (aggressive), I dialed in.

TSP Pilot gives me peace of mind and has allowed me to not stress when the market dips. I’ve followed all recommendations, since starting on TSP Pilot, and have watched my assets grow exponentially. I follow the recommended allocation when they are posted within a day, and I go about life, knowing that TSP Pilot, is at the controls with me as co-pilot.

Vonija S.

A TSP Pilot membership could easily pay for itself

.46%

Monthly Return (Conservative)

+

$157,325

Average Balance

=

$725.26

Potential Monthly Growth

Compare to G Fund .24% Monthly Equivalent as of February 14, 2025. Past returns not a guarantee of future returns. View calculations.

Our one-email money back guarantee

If TSP Pilot doesn’t meet your expectations during your first month, simply email our support team and request a refund. It’s that easy.

At TSP Pilot, we’re committed to ensuring your retirement journey is as comfortable as can be. From today until your last day, we’re here to support you every step of the way.

I wholeheartedly believe in the value our service brings, and I invite you to become part of our community today. Let’s embark on this journey together!

Jackson Rich

CEO of TSP Pilot

Invest Like a Pro Starting Today

100% Money Back Guarantee

Monthly

$19.95

- 14-day free trial

- Our example TSP allocations

- Regular market summary

- Text and email alerts

Easily cancel anytime

Yearly

$199.95

- 14-day free trial

- Our example TSP allocations

- Regular market summary

- Text and email alerts

Easily cancel anytime

Frequently Asked Questions

If you sign up annually it only costs $199.95 for the whole year. But if you want to take it one month at a time it’s $19.95 – and you can cancel any time. But why not get started with our 14-day free trial and try before you buy?

No. You have all the decision-making power when it comes to moving your funds. We just give you our expert opinion – then it’s up to you if you choose to follow our lead or not.

Absolutely. You can easily cancel your membership at any time on your Account Settings page.

Yes. TSP Pilot offers all new subscribers a two-week free trial to test out our service. To sign up for a free trial click here.

We hope you will love TSP Pilot and reap all the benefits of our service. But, if it isn’t right for you, just let us know that you would like a refund during the first 30 days and we’ll take care of it.

Yes. Our website has an SSL Certificate which means that all connections are fully encrypted. On top of that, we don’t store any personal payment information. All payment information is handled by a third party, Stripe, which is a certified PCI Service Provider Level 1, the most stringent level of certification available in the payment industry.

We send updates bi-weekly, but with the TSP only allowing 2 trades a month, sometimes we’ll suggest doing nothing at all. How often you need to take action really depends on the markets and what our experts think will get you the best returns.

If you are having a hard time creating an account it could be because you already have an active account with TSP Pilot. Contact us and we’ll take care of it!

We’re right here for you – and any questions you might have. Get in touch via our contact page or use our live chat.

Try for free today

14-day free trial. Cancel anytime.

More Testimonials

⭐⭐⭐⭐⭐

I don’t have worry about my funds. I read the messages, and follow their instructions. Done.

– Martha V.

⭐⭐⭐⭐⭐

Very time detailed information allowing me to make smart decisions in regards to my TSP ACCOUNT!

– Joseph N.

⭐⭐⭐⭐

TSP Pilot removes the hassle of and uncertainties of investing on my own. I joined TSP PILOT 10 or more years ago after seeing it in FedSmith years ago. I tried it for a year and have not looked. Only wish I had found it sooner. I’ve stayed the course as recommended by TSP Pilot. I am pleased with my investments. I know I would not be where I am without TSP Pilot. Thank you so much.

– Linda B.

⭐⭐⭐⭐⭐

Right on time. Helped me effortlessly recover. Thank you.

– Daniel M.

⭐⭐⭐⭐⭐

I’ve been using tsp pilot for many years. They keep me from the huge losses and still positioned to take advantage the huge gain

– Samuel H.

⭐⭐⭐⭐⭐

It is a reliable and good guide for people who do not have economic knowledge like me.

– Robert O.

⭐⭐⭐⭐

I have not used the TSP Pilot in several years but when I did, I found it generally helpful.

– Thomas O.

⭐⭐⭐⭐⭐

TSP Pilot has provided me with excellent TSP funds allocation guidance since I signed up in 2006 (I believe that was my initial year). Having gone through a divorce, all I had was a $70K TSP balance, with a $35K TSP loan against it. Using TSP Pilot guidance on allocation distributions between the various Funds and trying to invest at the yearly IRS maximum amount (at that time about $20K), I was able to “grow” my TSP balance to approximately $450K at the end of 2013. I retired from federal service in July 2015 and managed to add additional 401K funds from a post retirement (civilian job) for a 2 year period into my TSP account and I now have an approx. $550K TSP balance; having fully retired in June 2017. Good Luck? … maybe, but I’m going to go with sound investing strategy (sometimes Aggressive portfolio distributions … sometimes Conservative portfolio distributions) – and always sound market analysis from TSP Pilot. Thank you.

– Guy N.

⭐⭐⭐⭐⭐

I feel confident TSP Pilot has my best interests at heart.

– Sherrie F.

⭐⭐⭐⭐⭐

I have been using TSP Pilot for over 10 years and during that time I have always seen growth even when the market has been down my losses were not that bad.

– Stuart S.

⭐⭐⭐⭐⭐

I’m retired and no longer have TSP but I have mutual funds and remain a subscriber because it is an easy way to follow the market

– John P.

⭐⭐⭐⭐

I appreciate the detailed monthly summary of economic news even when allocations remain unchanged, and detailed rationale when changes are recommended.

– James B.

⭐⭐⭐⭐⭐

TSP Pilot has helped me increase my return on my money. I could not have achieved a better return investing on my own.

– George R.

⭐⭐⭐⭐⭐

I pull out money every month and still have more in my account then when I retired. TSP Pilot removes all worries about good investments.

– Bryan H.

⭐⭐⭐⭐⭐

I’ve used it for over a decade. It’s fast, easy, and painless – just what I want it to be.

– Rob M.