Financial Insights for TSP Investors

Invest Your TSP Like a Pro

- User-friendly, effortless access to example TSP portfolios

- Stay current with our bi-weekly analysis

- Consistently delivering results since 2004

- 14-day free trial

100% Money Back Guarantee

- 19 years of experience

- Set up in minutes

- 2,000+ Members

- 19 years of experience

- Set up in minutes

- 2,000+ Members

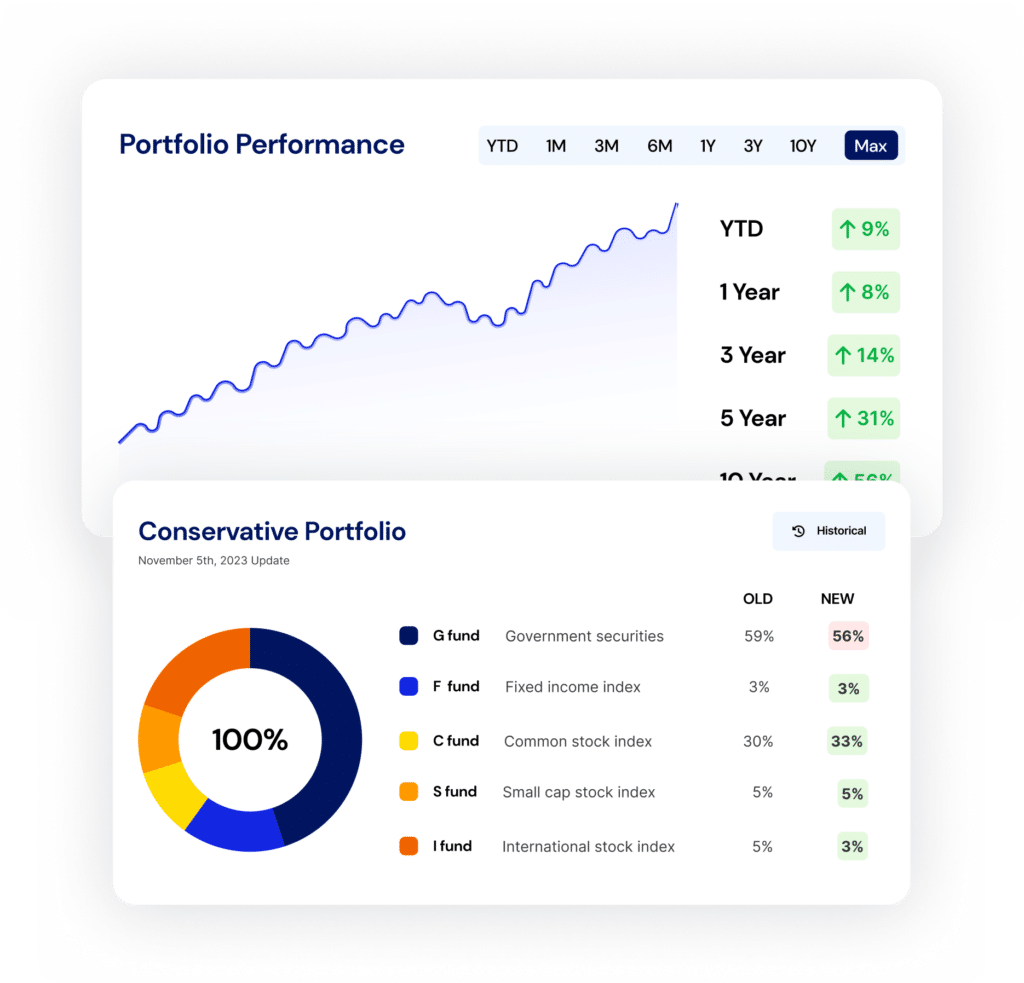

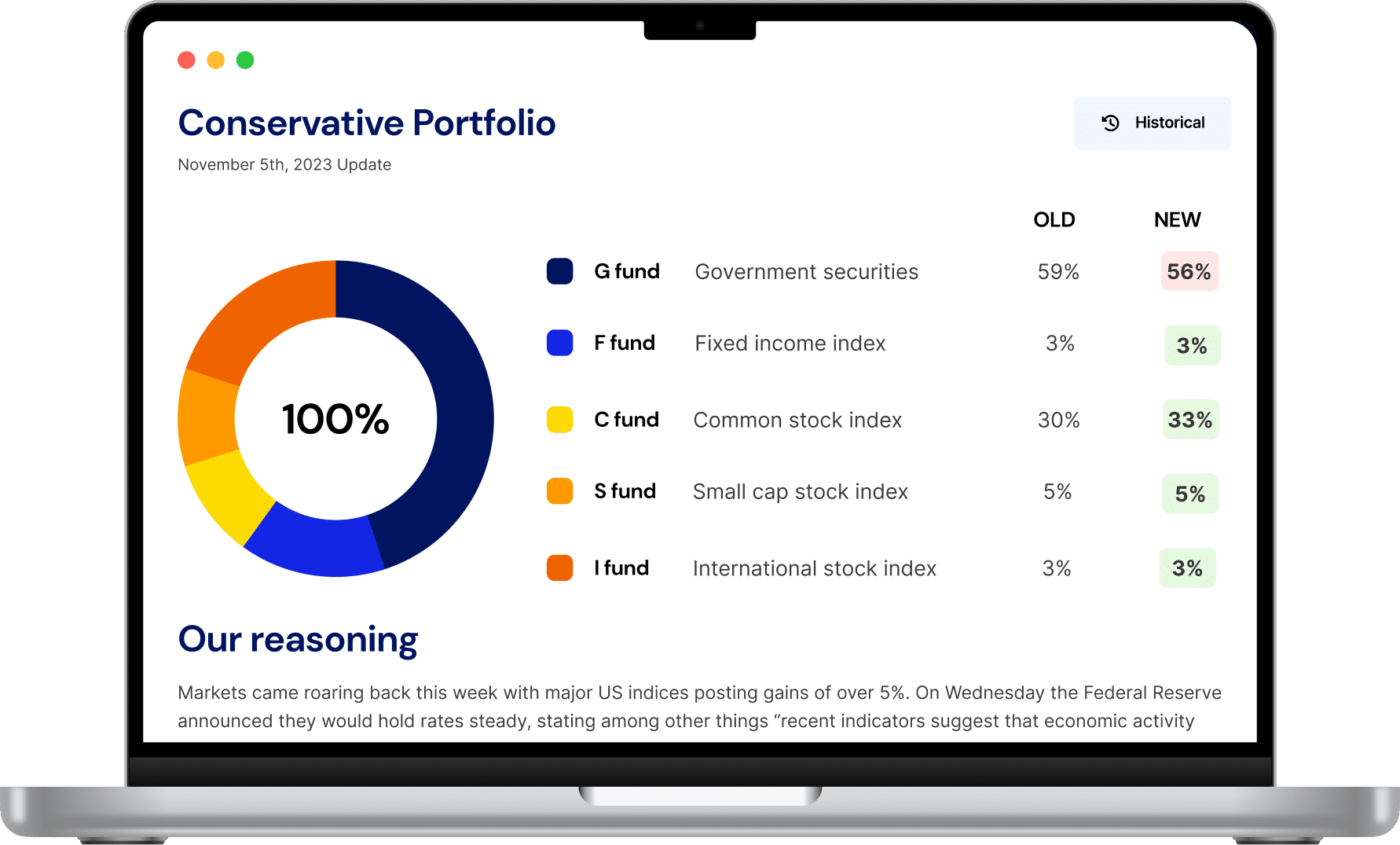

G Fund | L Income | Conservative | Aggresive | |

|---|---|---|---|---|

Average return over 10 years | 2.30% | 4.15% | 4.59% | 6.46% |

$100k invested over 10 years | $125,532.55 | $150.173.31 | $156,639.62 | $187,009.91 |

Based on 10 year annualized returns as of November 30, 2023

Don't Just Take Our Word For It

“TSP Pilot takes the guesswork out of it for me”

“I like the straightforward format and layout of the website.

Why TSP Pilot

Simplified, Actionable Analysis

Take the guesswork and emotion out of investing and rely on our objective opinion and proven experience.

Bi-Weekly Analysis Update

Weekly emails and texts will tell you how to manage your TSP like a pro – with full breakdowns on our members-only dashboard.

Proven Profits Since 2004

Rest assured knowing that TSP Pilot has performed exceptionally well since our 2004 inception, withstanding the test of time through both bull and bear markets.

Understand the market with a glance

100% Money Back Guarantee

- 19 years of experience

- Set up in minutes

- 2,000+ Members

- 19 years of experience

- Set up in minutes

- 2,000+ Members

Having been with the Federal Government for nearly 20 years, I enrolled in the TSP Pilot early on. Having sound market knowledge from the TSP Pilot has enabled me to build toward a sound and comfortable retirement.

Inspite of the current market challenges, I remain assured, my money is protected from market turbulence. I highly recommend anyone participating in the TSP subscribe to TSP Pilot.

Travis M.

How it works

Choose your preferred plan

Pick from our monthly and yearly memberships – all with a 14-day free trial and our money-back guarantee.

Log into your dashboard

Take a look at our most recent Commentary. When an update is posted, we’ll send you an email or text.

You move your funds yourself

You can decide if you want to follow our lead. Make fund changes via TSP.gov as you normally would.

100% Money Back Guarantee

I started on TSP Pilot in 2010 after a co-worker told me about it. Once I decided on my risk level (aggressive), I dialed in.

TSP Pilot gives me peace of mind and has allowed me to not stress when the market dips. I’ve followed all recommendations, since starting on TSP Pilot, and have watched my assets grow exponentially. I follow the recommended allocation when they are posted within a day, and I go about life, knowing that TSP Pilot, is at the controls with me as co-pilot.

Vonija S.

Over $449,669,461 in estimated returns for our members§

A TSP Pilot membership can pay for itself

.44%

Monthly Return (Conservative)

+

$157,325

Average Balance

=

$692.23

Potential Monthly Growth

Compare to G Fund .23% Monthly Equivalent as of March 21, 2024. Past returns not a guarantee of future returns. View calculations.

Invest Like a Pro Starting Today

- Our example TSP allocations

- Regular market summary

- Text and email alerts

- Our example TSP allocations

- Regular market summary

- Text and email alerts

100% Money Back Guarantee

Our one-email money back guarantee

If TSP Pilot doesn’t meet your expectations within your first month, simply contact our support team, and we’ll promptly refund 100% of your purchase.

At TSP Pilot, we’re committed to ensuring your retirement journey is as comfortable as can be. From today until your last day, we’re here to support you every step of the way.

I wholeheartedly believe in the value our service brings, and I invite you to become part of our community today. Let’s embark on this journey together!

Jackson Rich

CEO of TSP Pilot

Frequently Asked Questions

If you sign up annually it only costs $249.95 for the whole year. But if you want to take it one month at a time it’s $24.95 – and you can cancel any time. But why not get started with our 14-day free trial and try before you buy?

No. You have all the decision-making power when it comes to moving your funds. We just give you our expert opinion – then it’s up to you if you choose to follow our lead or not.

Absolutely. You can easily cancel your membership at any time on your Account Settings page.

Yes. TSP Pilot offers all new subscribers a two-week free trial to test out our service. To sign up for a free trial click here.

We hope you will love TSP Pilot and reap all the benefits of our service. But, if it isn’t right for you, just let us know that you would like a refund during the first 30 days and we’ll take care of it.

Yes. Our website has an SSL Certificate which means that all connections are fully encrypted. On top of that, we don’t store any personal payment information. All payment information is handled by a third party, Stripe, which is a certified PCI Service Provider Level 1, the most stringent level of certification available in the payment industry.

We send updates bi-weekly, but with the TSP only allowing 2 trades a month, sometimes we’ll suggest doing nothing at all. How often you need to take action really depends on the markets and what our experts think will get you the best returns.

If you are having a hard time creating an account it could be because you already have an active account with TSP Pilot. Contact us and we’ll take care of it!

We’re right here for you – and any questions you might have. Get in touch via our contact page or use our live chat.

Try for free today

14-day free trial. Cancel anytime.